Definition: RSI diversence is a technical tool for analysis that compares the price change of an asset with the direction it has relative strength (RSI).

Signal: A positive RSI signal is thought of as a positive sign of bullishness, whereas the negative RSI deviation is believed to be bearish.

Trend Reversal - RSI divergence may indicate an upcoming trend reversal.

Confirmation RSI Divergence should be employed alongside other analysis tools to serve as an instrument for confirmation.

Timeframe: RSI divergence is possible to be viewed over different timespans in order to get diverse perspectives.

Overbought/Oversold RSI values above 70 indicate an overbought condition. Values lower than 30 mean that the market is undersold.

Interpretation: To understand RSI divergence correctly requires taking into account additional fundamental or technical aspects. View the top backtesting for blog recommendations including trading with divergence, forex tester, trading platform, backtesting, crypto trading backtester, stop loss, RSI divergence, automated trading, backtesting platform, backtesting and more.

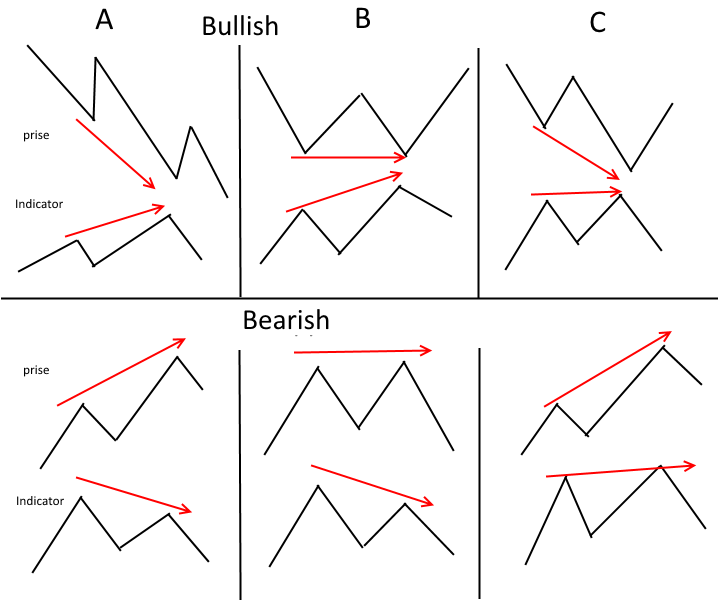

What Is The Difference Between Normal Divergence And Hidden Divergence?

Regular Divergence: Any price change that can cause an asset to make an upper high/lower low, and for the RSI to create a lower low/higher high is referred to as regular divergence. It could indicate an inverse trend. But it is important for you to also consider technical and fundamental factors. Although this signal is not as powerful as regular divergence, it can still indicate potential trend reversal.

The technical aspects to be taken into consideration:

Trend lines and support/resistance indexes

Volume levels

Moving averages

Other technical indicators and oscillators

Important aspects to take into consideration:

Releases of economic data

Details specific to your company

Market sentiment and indicators of sentiment

Global developments and their effects on the market

Before making investment decisions based only on RSI divergence indicators, you must be aware of both technical and fundamental factors. Check out the recommended stop loss for site info including backtesting strategies, online trading platform, cryptocurrency trading, crypto trading backtesting, backtesting trading strategies, best forex trading platform, forex tester, best forex trading platform, backtesting strategies, trading platforms and more.

What Are The Best Strategies For Backtesting Trading Crypto?

Backtesting crypto trading strategies involves replicating the operation of a trading plan using historical data in order to determine its profitability. The following are some steps in backtesting crypto trading strategies:Historical Data: Obtain a historical data set for the crypto asset being traded, including prices, volume, and other relevant market data.

Trading Strategy - Define the trading strategy being used that includes rules for withdrawal and entry, position size, and rules of risk management.

Simulation Software: Make use of software to simulate the execution of the trading strategy based on the historical data. This lets one visualize how the strategy might be performing over time.

Metrics: Evaluate the performance of the strategy by using measures such as profitability Drawdown, Sharpe ratio and other measures that are relevant.

Optimization: Change the parameters of the strategy to maximize the strategy's performance.

Validation: To make sure that the strategy is reliable and avoid overfitting, verify its effectiveness using data outside of sample.

Keep in mind that past performance shouldn't be interpreted as an indicator for future results. Backtesting results are not an assurance of future profits. Live trading is a live-action scenario and therefore it is vital to account for the volatility of markets and transaction costs and other relevant elements. Check out the top forex backtesting software for website advice including backtesting strategies, backtesting trading strategies, backtester, automated crypto trading, backtesting, forex backtest software, trading platform, automated trading, automated trading platform, automated trading platform and more.

What Do You Need To Do To Test The Forex Backtest Program When Trading With Divergence

These are the main considerations when evaluating backtesting software for forex that permits trading with RSI Divergence.

Flexibility: Software needs to be able to accommodate customization and testing of various RSI divergence trading strategies.

Metrics: This software should offer a wide range of metrics that are used to evaluate the effectiveness and profitability of RSI divergence strategies.

Speed: Software must be fast and efficient in order to enable multiple strategies to be backtested quickly.

User-Friendliness: The software should be simple to use and understand, even for those with no technical expertise.

Cost: Consider the cost of the software, and whether it is in your budget.

Support: The software must come with good customer support, including tutorials as well as technical assistance.

Integration: The software needs to be able to work with other trading software , such as charting programs or trading platforms.

It is important to test the software using the demo account prior to purchasing the subscription. This will allow you to verify that the software meets your requirements and you are comfortable using it. See the most popular trading divergences for more info including divergence trading forex, trading platform crypto, crypto trading bot, stop loss, forex tester, backtesting strategies, trading platforms, best crypto trading platform, trading platform crypto, cryptocurrency trading bot and more.

What Are The Functions Of The Automated Trading Software's Cryptocurrency Trading Bots Function?

These bots trade cryptocurrency by using automated trading software. They adhere to an established set of guidelines to make trades on user's behalf. The following is the basic strategy: The user decides a trading plan, which includes the criteria for entry and exit, position sizing, risk management and risk control.

Integration via APIs the trading bot could be integrated with cryptocurrency exchanges. This allows it to access real time market data and then execute trades.

Algorithm : The bot employs algorithms for market analysis and trades based on an established strategy.

Execution: The bot automatically executes trades in accordance with the rules outlined in the trading strategy, without manual intervention.

Monitoring: The bot watches the market continuously and adjusts the trading strategy accordingly.

A cryptocurrency trading robot can help you execute repetitive or complex strategies. It is important to recognize that automated trading can have its own risk. Software bugs, security issues, and the loss of control over trading decisions are one of the potential dangers. Before you use any trading robot for live trading, it is crucial to evaluate it thoroughly and test the bot.